KYC and AML in Online Gambling in 2026

KYC means knowing your player; AML means knowing their money is clean. Together, these standards of regulatory compliance now decide who survives in the online gambling industry.

If your verification process still causes drop-off, delays, or errors, you’re not ready to gamble online in 2026. Compliance affects conversions, VIP onboarding, and how you grow. And yes, poor tools may disqualify you from launching in high-value regions.

You Will Learn

As of July 2026, EGBA confirmed a sector-wide push to raise AML standards — urging all operators to take part or risk regulatory disadvantages in the near future

So yes, KYC and AML define how far your business can go. This article shows how to make compliance your advantage with modern tools and proven workflows. You’ll discover how to boost performance and meet today’s demands confidently. With trusted online casino software by NuxGame, you’ll build systems that meet expectations and support growth.

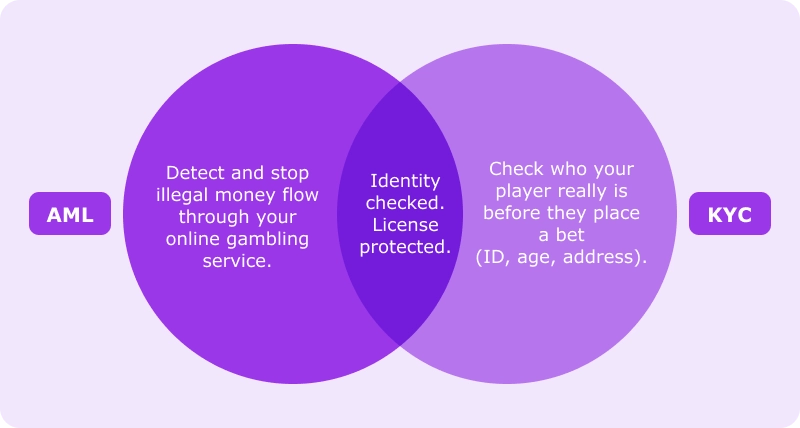

KYC Verifies People, AML Follows the Money

Here’s the simplest way to look at it: KYC is about who your player is. AML is about where their money comes from. You need both to stay compliant, keep your license, and run a platform players can trust to gamble online.

KYC (Know Your Customer) verifies identity before play. If your system can’t check age, address, or location fast — you lose players and raise red flags. That’s a responsible gambling risk.

AML (Anti-Money Laundering) watches for misuse of your iGaming service. Big cash-ins with low play. Crypto deposits with unclear origin. It’s how you stop criminal behavior from hiding behind a sportsbook or casino brand.

These standards are a hard requirement for getting an online gambling license from the UKGC, MGA, or Curacao in 2026. If you can’t prove that you spot crypto risks and shady play patterns, regulators won’t let you operate.

Global Regulatory Pressure: Why KYC/AML Can’t Wait

Player verification standards are now both a legal requirement and a daily stress for gambling operators. If your gambling AML KYC software doesn’t meet market-specific expectations, you’re betting on delays, fines, or even shutdowns.

AML compliance now needs to detect threats as they happen. Sweden now expects all gambling operators to run real-time ID checks and confirm where large deposits come from. You must flag risky play and verify high-value players thoroughly. And when operators overlook critical checks, regulators act fast. UKGC recently fined ProgressPlay £1 million for failing to check source-of-funds and breaching AML rules across its 134 gambling sites.

The challenge multiplies for international brands: KYC processes that work in one country may be rejected in another (especially in stricter markets such as Sweden or the Netherlands). Add slow ID flows or manual checks, and you lose VIPs during onboarding. The result is sad: lost bets, broken trust, stuck growth. Use this table to see where your current setup may fall short.

KYC and AML Regulations in Major iGaming Jurisdictions

| Country | KYC | AML | Crypto | Notes |

| Malta | Yes | Yes | Conditional | Crypto users must show source of funds |

| Curacao | Yes | Basic | Yes | New AML laws active: enhanced checks |

| UK | Strict | Advanced | No | Pre-deposit ID verification; crypto banned |

| Sweden | Yes | Yes | Yes | Immediate verification of ID, funds, and PEPs |

How to Meet KYC Rules Without Losing Players

Operators don’t want to choose between staying license-ready and growing their player base. And you shouldn’t have to in 2026. The foundation of scaling your brand is integrating identity verification into a user-friendly online casino gameplay session — one that satisfies both users and regulators. With underage gambling and fraud still frequent, regulatory requirements demand tighter control. But clean interfaces speed up checks and boost your revenue,

Wise operators do this to both meet regulatory rules and keep players happy:

- Use tools like Jumio or Sumsub to automate KYC checks.

- Offer live support to guide players through ID steps.

- Let users start playing with basic info and delay full checks until they try to withdraw or spend big.

- Apply stronger KYC only to high-risk players (not everyone).

- Keep all documents safe, and make sure they’re reviewed or updated on time.

With new technologies in iGaming, meeting regulations no longer means frustrating your players. The right KYC flow doesn’t push players away: it filters the wrong ones.

The Future of Identity Checks in Online Gaming

KYC and AML are changing fast — and smart operators are watching closely. Tomorrow’s tools will need to work faster and better to improve online casino gaming experience. Players expect signups in seconds instead of hours. Regulators expect you to catch risk before it happens. That’s where AI comes in: it spots unusual gambling activities and patterns that could signal money laundering before a human ever notices.

Biometric onboarding (facial recognition or fingerprint scans) is no longer a futuristic idea. It’s already used to verify the identities of players in strict markets. And blockchain could soon let verified users move between platforms without starting over.

But none of this matters if it doesn’t also support fast, safe iGaming payments for operators. The future of online gaming means KYC checks that are invisible to good players and tough on bad ones. The best gambling companies will be the ones that stay one step ahead: clean, quick, and regulator-ready.

I recommend that you treat KYC as a revenue filter. The faster you can confirm a player’s identity, the faster you can get them in the game. If your tools delay that step, you’re both risking fines and missing out on real business. Focus on workflows that transform verification into velocity. Every second saved during onboarding is a second closer to a deposit, a bet, or a lifetime user.

— Denis Kosinsky, Chief Operating Officer at NuxGame

Conclusion

You don’t get a second chance with regulators. And that warning is very real in 2026. One bad process can stop you from entering new markets or cost you your license. The solution is good software. AML and KYC in online casinos should protect your business instead of preventing it from expansion. When done right, KYC helps you meet every regulatory requirement and keep your players satisfied. Looking for a solution that works fast and stays fully license-ready? Give iGaming software from NuxGame a try: contact us now to start discussing your project!