Online Casino Regulations in the US

Online gambling laws in the United States are set individually by each jurisdiction: some states allow iGaming venues, others do not. This is important for online gambling operators because iGaming regulations now change faster than product strategies. One wrong assumption about online gambling laws can knock your market entry off course or block payments overnight. Naturally, a fragmented market like this requires operators to treat compliance as a growth tool (if they want to scale wisely, that is).

Regulators and state attorneys general are putting fresh focus on the Unlawful Internet Gambling Enforcement Act as 2025 closes. That specifically concerns how banks and payment processors handle US-facing gambling traffic, creating real pressure (but also new openings) for every gambling business. We are about to give you a clean, practical map of US gambling law and the exact regulations you must follow to grow safely while following all regulatory rules. Read on!

Quick Facts

Where Online Casino Is Legal in the US Now

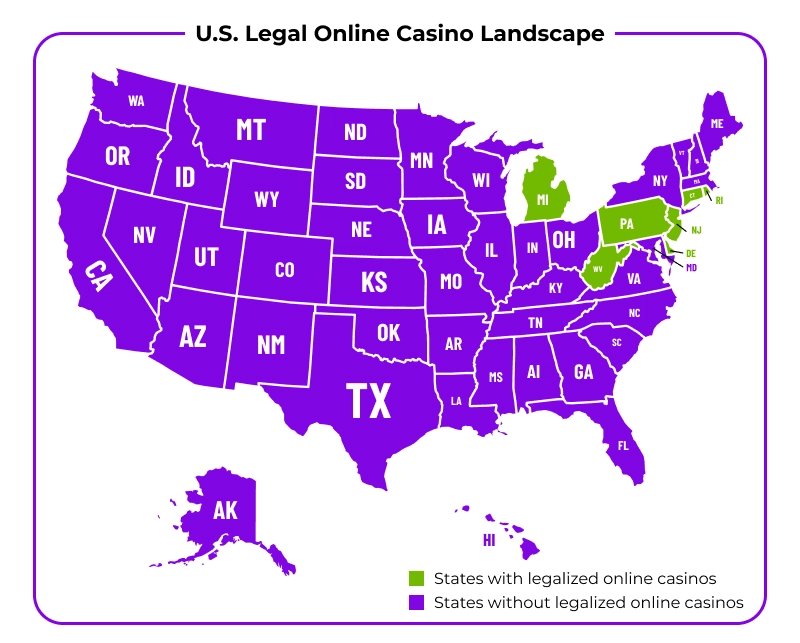

Knowing where online casino is legal right now is the foundation of a profitable US strategy. Only seven states fully regulate real-money online casino and online poker: New Jersey, Michigan, Pennsylvania, Delaware, West Virginia, Connecticut, and Rhode Island. Entering them requires a license, a land-based casino partner, and fully approved game technology. The requirements are thorough, but they’re also what makes these states predictable, low-surprise environments, the kind operators actually enjoy scaling in.

Sports betting, however, is far more widespread. Many states have legalized it without permitting online casino gambling, which made it a gateway vertical. Sports betting primes both regulators and players for the next step: to legalize online casino when political timing is right. But operators must monitor each state carefully: many allow betting on sports yet still restrict digital slots or table games.

Where real-money casino isn’t permitted, operators often start with social casinos, sweepstakes, or fantasy products. This avoids illegal gambling risk while still building a loyal audience ahead of regulatory change.

This list shows the main types of US markets available to operators right now:

- States with full casino and poker.

- Sports-only states.

- Tribal-managed markets.

- Lottery-led markets.

- Hybrid or partial-access states.

- Social/sweepstakes growth states.

- High-revenue markets likely to expand.

Once you understand the US market map, selecting your next US state becomes a strategic decision, not a gamble. This also lets you identify states currently rewriting online sports betting regulations, often updating requirements for operators, payment flows, or advertising practices. Such updates usually show that regulators are already thinking about future digital expansion, including potential online casino discussions. For operators, monitoring these changes is an easy way to plan ahead and prepare early for new openings.

Main Regulatory Requirements for Online Casinos in the US

US regulators care less about where you launch and more about how responsibly you operate. You can be building a large legal online casino, offering casino games, or working under sweepstakes online casino regulations: in either case, authorities expect solid controls for every gambling activity. The US now treats online wagering as a tightly managed form of gambling, requiring strong player protections, transparent marketing, and reliable technology. For operators, this means that compliance is the foundation of effective scaling.

These are the main regulatory focus areas determining modern online gambling sites:

- Mandatory limits, cooling-off tools, and self-exclusion.

- Real-time monitoring and unified player profiles.

- Verified identity, sanctions checks, and source-of-funds.

- Evidence of risk-based AML processes.

- No misleading ads or “risk-free” bonuses.

- Close supervision of affiliate marketing.

- Certified RNGs and fair-game audits.

- Strong cybersecurity and vendor oversight.

When operators meet these expectations, gambling operations become properly organized, approvals get faster, and risks decrease. Most importantly, it strengthens AML compliance in online gaming, as well as gives operators a more secure way to scale in the US.

Gray Areas in US Online Gambling: Offshore, Sweepstakes, and Tribal Models

Even with strong B2B iGaming solutions, operators in the US online gambling market face gray areas that don’t fit neatly into “legal” or “illegal.” Offshore platforms exist because players can still gamble online, but offering services to those markets exposes operators to banking restrictions, partner concerns, and risks linked to gambling transactions. Growing responsibly means choosing a cleaner approach to online gambling.

Sweepstakes and social casinos operate differently. They provide entertainment through virtual coins and prize entries, which makes them suitable for states that ban cash-based gambling. These models follow state-specific regulations, consumer protection rules, and strict marketing standards.

Tribal markets add another dimension. Sovereign tribes negotiate their own terms, from licensing rules to revenue-share agreements, creating unique long-term opportunities compared with commercial markets.

Here’s a clear overview of the US gray zones:

- Offshore player attraction.

- Banking and payment-flow challenges.

- Consumer-first sweepstakes frameworks.

- Virtual currency and prize mechanisms.

- Tribal licensing vs. commercial licensing.

- Long-term tribal partnership models.

- Compliance-focused social casino routes.

Learning these gray-area dynamics helps operators grow safely and make smarter decisions in the US market. It also shows why many brands use social products to stay visible without entering real-money territory too early. Choosing the best social casino site as an entry route lets operators test engagement, build an audience, and understand local behavior before regulations open further. This approach reduces risk and prepares operators for a natural transition into fully regulated markets.

Don’t treat sweepstakes and real-money iGaming as separate worlds. Treat them as neighboring lanes. Format your tech so a sweepstakes site can later convert into regulated iCasino with minimal rebuilding. That long-term flexibility saves you money and launch time when a state finally says Alright, let’s legalize this.

Denis Kosinsky

Chief Operating Officer at NuxGame

Licensing Strategy for Online Casino Operators in the US

Licensing is where operators translate regulation into real growth decisions. Even the strongest B2B gambling license framework won’t help unless you choose states that match your business model. Because the US lacks a single federal gaming standard, operators must compare states not only by whether legal online gambling exists but by how profitable it can be. That means understanding tax levels, marketing limits, partner requirements, and how your brand will compete across multiple forms of gambling, including online sportsbooks, without increasing problem gambling risks.

A wise licensing strategy evaluates:

- Revenue potential vs. licensing cost.

- Market maturity and competitive pressure.

- Tribal vs. commercial partnership models.

- Compliance expectations for vendors.

- Timeline for obtaining approvals.

- Tech readiness for state certifications.

- Marketing and CRM freedom.

- Payment and banking conditions.

This kind of structured thinking allows operators to choose markets that match their growth goals as opposed to their ambition. Once these decisions are grounded in data, the process to get an online gaming license becomes much simpler because your operational plan already fits what regulators expect.

Expert Tips for Succeeding in the US Online Gambling Market

The US doesn’t favor operators who improvise; it rewards operators with a plan. You can be focused on casino gaming, legal sports betting, or both: in either case, the wisest choice is one that combines business strategy with responsible gambling tools and transparent workflows. With many types of gambling and no unified regulatory system, online gambling operations succeed when every internal process is built to match the reality of states that allow different models.

Here’s your practical (and sanity-saving) guide with tips from NuxGame:

Start with regulatory mapping, not product dreams.

Compare real market margins, not hypothetical ones.

Select a platform that adapts easily to multiple state regulations.

Build bonus rules that regulators won’t frown at.

Centralize KYC, AML, and behavior monitoring.

Use one standard method for documenting all tech procedures.

Review marketing through a compliance lens.

Track competition levels early.

Last but not least: train online casino customer support to recognize risk patterns. With these habits, operators gain both compliance and stability. Your teams work faster, regulators trust you sooner, and every new launch feels less like a gamble and more like a well-timed expansion.

The Future of Online Casino Regulations in the United States

America’s next phase of iGaming trends will be influenced by two forces: state budgets and player demand. Both point to wider adoption of sports betting and online casino gaming, especially where neighboring states already enjoy the benefits. Regulation will mature too, so expect more precise, data-backed supervision, as well as tighter ads and increased focus on responsible gambling analytics. And as this happens, commercial casinos will look for B2B partners who can keep them competitive online.

For operators offering gambling services, the evolving legality of gambling means adapting quickly as states clarify rules for casino games like slots or live dealer products. The most strategic companies won’t fear regulation: they’ll use it to differentiate themselves. In fact, preparation is now the foundation of long-term success. The right structure and attitude creates conditions where even an iGaming startup can scale confidently in a market that never stops changing.

Wrapping It All Up

The smartest move is usually the one made before everyone else sees it: and this is especially true in the iGaming scene. As US federal law updates and states refine their gambling regulations, operators who stay ahead of gambling issues gain a real competitive edge. The first states to legalize online casinos proved that structured planning beats random decisions every time. And the next stage of legal gambling states will reward the same readiness. If you’re ready to expand with confidence (and avoid costly surprises), partner with NuxGame. Our expert iGaming legal services make US expansion faster, safer, and far more predictable.